💰 Growth of $1000#

If you invested $1000 in QQQ starting from 2010/12, and held it for 15 years, by

2025/12 it would be worth $11280.02, with a total return of 1028.00% (annualized return of 17.53%).

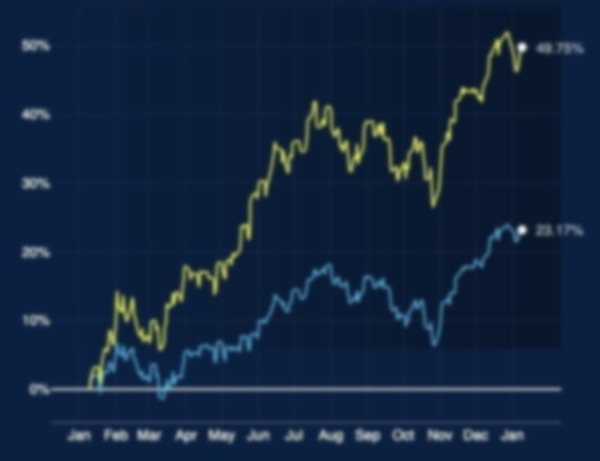

📈 Market and Constituent Stocks#

🔗 Maybe you want to know more#

| Website | Description |

|---|---|

| Invesco QQQ | Official QQQ Website |

| QQQ Holdings | QQQ Holdings List |

| QQQ Financial Ratios | Summary of QQQ Financial Ratios |

| QQQ Historical Returns | QQQ Historical Performance from various perspectives |

| QQQ Finance Charts | QQQ Finance Charts Information |

| QQQ price prediction | The Economy Forecast Agency |

| How to Invest in NASDAQ 100 | NASDAQ 100 Investment Information |

| If you invest QQQ 💰 | QQQ Investment Return Calculator |

A One Hundred Million Investment Life Lecture

CLEC

Investment

Financial Freedom

Compound Interest

Nasdaq 100

Index Funds

Long-Term Investment

US Market

Technology

Poor Mindset

Stock Pledge

Independent Thinking

Financial Independence