Appendix 1: Understanding Compound Interest#

Accumulating wealth isn’t about cutting expenses,

but about the compounding power of money making money.

Albert Einstein, considered one of history’s greatest scientists, was once asked, “What is the most powerful force in the world?” His answer wasn’t the force of colliding planets or the power of a nuclear explosion, but “compound interest.”

As the previous examples demonstrate, the factor that allows a yearly saving of 14,000 yuan to grow to over 100 million yuan in 40 years is “compound interest.” Since compound interest is the primary driver of accelerated wealth growth, understanding it is crucial for achieving financial success.

Imagine two job offers: one with a monthly salary of 100,000 yuan, and another starting at 1 yuan in the first month, doubling each subsequent month. Assuming both jobs last two years (24 months), which would you choose?

At first glance, the first offer seems better. 100,000 yuan monthly yields 2.4 million yuan over 24 months. However, anyone understanding compound interest would choose the second job, which yields over 16.77 million yuan after 24 months! This is the effect of compounding. While this is an extreme example, such high growth rates are unlikely in reality. Nevertheless, it clearly demonstrates the power of compound interest.

Most people have a basic understanding of compound interest. Depositing money in a bank generates interest over time, a common understanding in modern society. Since Einstein considered compound interest the most powerful force, and it can help us become millionaires with modest investments, a deeper understanding of its workings is essential, especially for those interested in financial management.

Simply put, compound interest is “interest on interest.” We know bank deposits earn interest, calculated using compound interest. For instance, with a 10% interest rate, a 1,000 yuan deposit earns 100 yuan in interest in the first year, resulting in 1,100 yuan. If left in the bank, the second year’s interest is 110 yuan (on 1,100 yuan), totaling 1,210 yuan. The third year yields 121 yuan in interest, reaching 1,331 yuan.

Notice the increasing interest earned each year. This is because the first year’s interest earns interest in the second year, and so on, leading to an ever-increasing return. This “interest on interest” phenomenon is compound interest.

The table below shows that after the 26th year, the annual interest earned surpasses the principal, and by the 40th year, the interest of 4,114 yuan is more than four times the initial 1,000 yuan principal.

Future Value of 1,000 Yuan at 10% Interest Rate (Compounded Annually)

| Year | Beginning Value | Ending Value | Interest |

|---|---|---|---|

| 1 | 1000 | 1100 | 100 |

| 2 | 1100 | 1210 | 110 |

| 3 | 1210 | 1331 | 121 |

| … | … | … | … |

| 26 | 10835 | 11918 | 1083 |

| … | … | … | … |

| 39 | 37404 | 41145 | 3740 |

| 40 | 41145 | 45259 | 4114 |

Compound interest’s effect varies with different interest rates and durations. These variations are presented in compound interest tables (refer to this appendix). These tables, composed of interest rates, years, and future value factors (the growth multiplier calculated by the formula), might seem daunting with their numerous figures. However, understanding them is invaluable for investment and financial management. Renowned American financial advisor Venita VanCaspel calls the compound interest table the “eighth wonder of the world.” If you don’t have the opportunity to travel the world, studying this table can be just as rewarding. Understanding the characteristics of compound interest is key to leveraging its power for wealth creation.

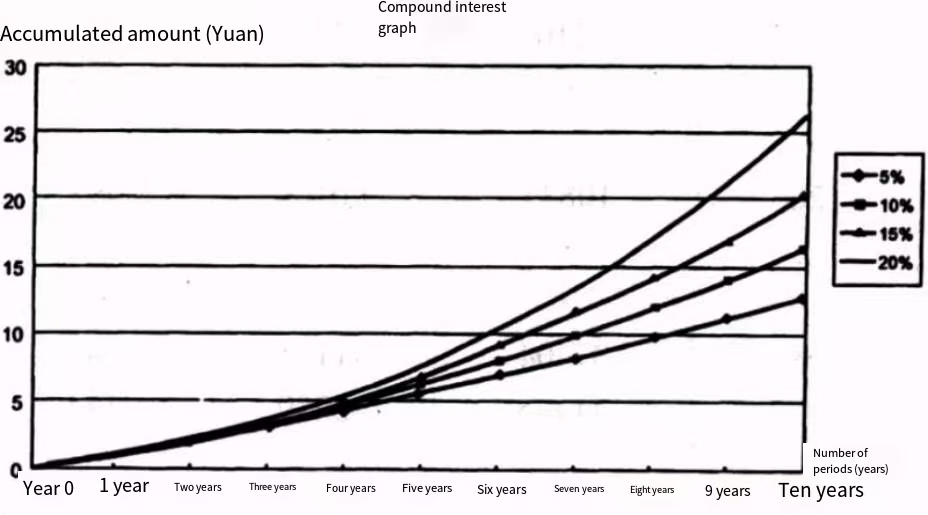

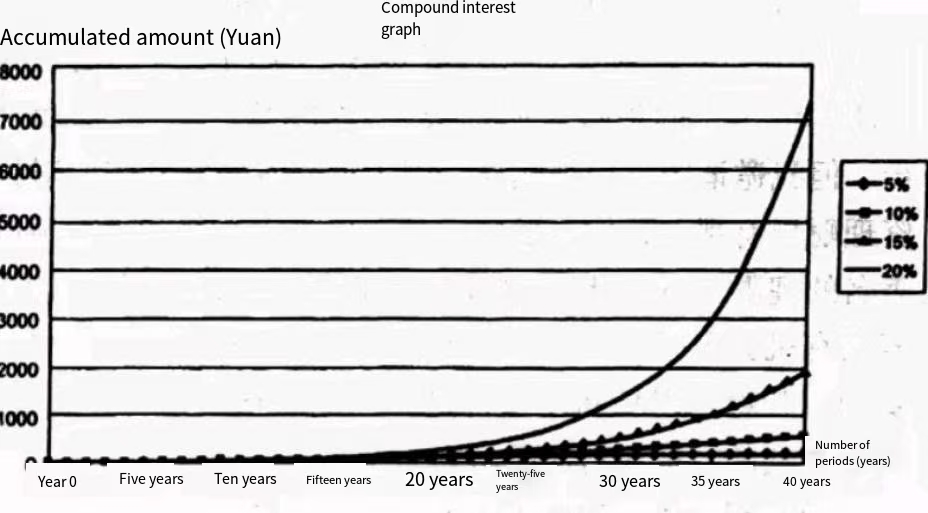

The compound interest table reveals that the values increase with time and interest rate. However, this isn’t the whole story. Observing compound interest graphs derived from these tables reveals further insights. Figure 1-1 assumes a yearly deposit of 1 yuan at different interest rates, plotting asset growth over 10 years. Figure 1-2 uses the same assumptions but extends the time horizon to 40 years.

Figure 1-1: Future Value Growth of 1 Yuan Annuity at Different Interest Rates over 10 Years

Figure 1-2: Future Value Growth of 1 Yuan Annuity at Different Interest Rates over 40 Years

These graphs illustrate the growth of 1 yuan over time at various interest rates and durations. Comparing them reveals two key characteristics of compound interest:

- As the duration (time) increases, the future value rises continuously, and the rate of increase accelerates. This is known as exponential growth. Given sufficient time, the growth becomes dramatic, with the curve eventually approaching a straight upward line.

- Different interest rates result in significantly different growth curves. Over decades, the disparity between high and low interest rate curves becomes immense.

In summary, the secret to accumulating significant wealth from small beginnings lies in leveraging the “money making money” power of compound interest. Compounding has two key features: its effect is more pronounced over longer periods, and higher returns amplify its impact. Applying these principles to investing leads to two conclusions:

- Invest in high-return assets like stocks and real estate. Higher returns maximize the effect of compounding, while low returns yield minimal benefits. To fully harness the power of compound interest, capital must be invested in high-return assets.

- Hold investments long-term. The longer the investment horizon, the more significant the compounding effect. Short-term investments don’t allow sufficient time for compounding to work its magic. Therefore, long-term holdings in high-return assets are crucial for maximizing the benefits of compound interest.

Appendix 2: Blueprint for Financial Success#

Everyone’s age, personality, and applicable tax rates differ. Therefore, each individual needs a tailored approach to wealth accumulation. I can’t provide personalized financial planning advice based on your specific circumstances, nor can I encompass everyone’s financial situation and plans with a few generic examples.

To help you design your own “Blueprint for Financial Success,” I’ve combined the future value and annuity future value formulas from finance to create a universal “Investment Wealth Formula.” This formula empowers readers to plan their lifelong financial strategies based on their unique circumstances and objectives.

The values for the complex calculations in the formula above (Future Value Factor and Annuity Future Value Factor) can be found in Appendix 1 of this book.

- Future Value Factor: The future value of 1 yuan today, after N years, at an interest rate (or rate of return) of R%.

- Annuity Future Value Factor: The future value of an annuity of 1 yuan deposited at the end of each year, after N years, at an interest rate (or rate of return) of R%.

Using this formula, you can project your future wealth by inputting your current assets, average annual savings for investment, planned investment period, and expected annual rate of return. You can calculate the result or look it up in a table.

This formula simplifies the real-world situation, as investment returns are unlikely to remain constant each year, and annual savings might fluctuate. However, using the “average” annual rate of return and “average” annual investment amount generally provides a reasonable approximation of future wealth.

The purpose of the “Investment Wealth Formula” isn’t to predict future wealth precisely but to illustrate how investment builds wealth and how financial management leads to prosperity. It aims to bolster your confidence in financial planning, enabling you to focus on key principles, maintain perseverance, and steadily progress towards your financial goals throughout market fluctuations.

This isn’t a foolproof formula for riches. Following this method may lead to becoming a millionaire, but success isn’t guaranteed. However, inaction guarantees zero chance of success. The most valuable aspect of this wealth-building concept is the message: “Investment and financial management can lead to wealth.” This knowledge fosters optimism and hope. Regardless of your current wealth, age, annual savings, or investment skills, with dedication, determination, and a willingness to learn, you can leverage investing to grow your wealth.

After understanding this formula, follow these steps for financial planning:

I. Data Collection:

- What is your current total asset value? (Include bank deposits, stocks, real estate, etc.)

- How much do you anticipate saving annually for investment?

- What is your expected average annual investment rate of return?

- How many years do you plan to invest before reaching your financial goal?

- What is your future wealth target?

II. Calculation and Analysis:

- Use the five data points above with the “Investment Wealth Formula” to assess the feasibility of your wealth plan. If it’s not feasible, how will you adjust? Will you increase savings? Improve investment skills to boost returns? Lower your wealth target? Or extend your time horizon? Adjust the variables and recalculate until you find a realistic and achievable plan.

- Calculate your projected accumulated wealth based on your current assets, investment period, annual savings, and expected rate of return.

- You can also use any four of the five variables (current wealth, target year, annual savings, rate of return, wealth target) to calculate the remaining variable. (Calculating the target year or rate of return using the other four variables requires a financial calculator or trial and error to find an approximate value.)

While the “Investment Wealth Formula” involves a seemingly complex mathematical formula, its primary purpose is to explain the principles of wealth building, not to complicate financial management or confuse readers. If you don’t have a calculator or prefer not to delve into the formula’s calculations, feel free to disregard it.

Using the “Investment Wealth Formula” can help you plan your future finances and boost your confidence in financial management. However, it doesn’t guarantee investment success. Pre-planning is just the beginning; the key lies in mastering investment principles and consistent action. When starting your financial journey, clarify your financial situation, set realistic wealth goals, then use the “Investment Wealth Formula” to evaluate your investment strategy and timeline. Remember, the path to wealth is in your hands.

Example: Zhang San is 30 years old with 200,000 yuan in savings. After reading this book, he resolves to become a millionaire (meaning having 100 million yuan). He plans to invest 100,000 yuan annually in stocks and real estate with an expected 20% annual return, aiming to reach his goal by age 50. Let’s use the “Investment Wealth Formula” to assess the feasibility.

Based on the calculation, Zhang San’s 200,000 yuan initial investment, along with 100,000 yuan annual investments over 20 years at a 20% average return, will yield approximately 26 million yuan, less than one-third of his 100 million yuan goal. To become a millionaire, he can improve his return, increase his annual investment, or extend his time horizon. A 20% return is already quite good and realistic, even for seasoned investors. Increasing his returns further might be challenging. Since he doesn’t want to extend the timeline, he decides to increase his annual investment. Through frugality and a part-time job, he manages to save 200,000 yuan annually. Let’s recalculate his future wealth after 20 years.

Even with doubled annual savings, his wealth after 20 years still falls short of half his goal. With both his 20% return and 200,000 yuan annual investment maxed out, he has to extend his timeline. He decides to aim for 25 years. Let’s calculate his projected wealth then.

He finally achieves his goal of becoming a millionaire after 25 years. Extending the timeline by just five years makes a significant difference. With a longer time horizon, his required annual investment could be even lower. This example validates the book’s emphasis on “youth being an asset in wealth building” and “the importance of long-term investing for realizing the power of compound interest.” Experiment with different variables to understand their impact. You’ll discover that the initial wealth and annual investment amount have a relatively small impact, while time and rate of return are the key drivers of wealth accumulation.

Your circumstances might be better or worse than Zhang San’s. Regardless, everyone has different starting points, but anyone can become a millionaire. Calculate your own path to becoming a millionaire based on your current situation. Remember, with a modest initial investment, allocation to high-return assets like stocks and real estate, and long-term holding, becoming a millionaire is absolutely achievable.

Now, set your financial goal. Write down your target wealth, your desired timeline, and how you plan to use your wealth to achieve your broader life goals.

Remember: “Money is a means to an end, not the end itself.”

Accumulating more money isn’t always better, and having more financial goals isn’t necessarily advantageous. Such an approach may prevent you from ever reaching your goals and trap you in a cycle of dissatisfaction and greed. You could become a slave to money and potentially harm future generations with excessive wealth, contributing nothing to yourself, your loved ones, or society.

Once you have a financial goal, use the “Wealth Formula” to calculate your path, including required annual savings and average rate of return. This will inform your investment strategy and timeline. More importantly, determine how you will utilize your wealth once you achieve your goal. This concretizes your aspirations. You’ll discover that by applying the principles in this book and remaining consistent, becoming a millionaire is within reach. A clear goal leads to a happier life, and a positive attitude contributes to success in all areas of life.